MOST Common Government Loan Programs

On this page, we will highlight the following most common government loan programs:

- FHA Loans

- VA Loans

- USDA Loans

FHA loans

An FHA loan is insured by the Federal Housing Administration, a federal agency within the U.S. Department of Housing and Urban Development (HUD). The FHA does not loan money to borrowers, rather, it provides lenders protection through mortgage insurance (GAP) in case the borrower defaults on his or her loan obligations. Available to all buyers, FHA loan programs are designed to help creditworthy low-income and moderate-income families who do not meet requirements for conventional loans.

FHA loan programs are particularly beneficial to those buyers with less available cash.

Some of the benefits of FHA financing:

- 3.5 percent down payment is required ( on a regular FHA purchase)

- FHA loans are also used to purchase a HUD REO home and you are only required to put $100 down on these loans. Click Here for more info.

- More flexible underwriting criteria than conventional loans and better rates than conventional loans in our current market for borrowers with credit scores less than 720

- Loans are assumable to qualified buyers. This can potentially be a HUGE benefit if needing to sell home 2-5 years after purchase and rates are at 5.5% at that time. A potential homebuyer would LOVE to assume your 3.375% FHA Fixed rate.

We do also offer the FHA 203K Renovation Loans.

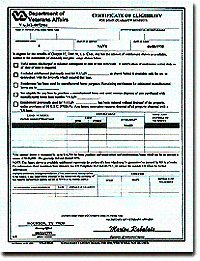

VA Loans

VA guaranteed loans are made by lenders and guaranteed by the U.S. Department of Veteran Affairs (VA) to eligible veterans for the purchase of a home. The guaranty means the lender is protected against loss if you fail to repay the loan. In most cases, no down payment is required on a VA guaranteed loan and the borrower usually receives a lower interest rate than is ordinarily available with other loans.

Other benefits of a VA loan include:

- Closing costs are comparable and sometimes lower - than other financing types.

- No private mortgage insurance requirement.

- The Mortgage can be taken over (or assumed) by the buyer when a home is sold.

- Counseling and assistance available to veteran borrowers having financial difficulty or facing default on their loan.

Although mortgage insurance is not required, the VA charges a funding fee to issue a guarantee to a lender against borrower default on a mortgage. The fee may be paid in cash by the buyer or seller, or it may be financed in the loan amount.

A VA loan can be used to buy a home, build a home and even improve a home with energy-saving features such as solar or heating/cooling systems, water heaters, insulation, weather-stripping/caulking, storm windows/doors or other energy efficient improvements approved by the lender and VA.

Veterans can apply for a VA loan with any mortgage lender that participates in the VA home loan program.

USDA Loans

USDA loans offer huge benefits to potential homeowner's. These loans are backed by the USDA (yep -same as the USDA Beef - Dept. of Agriculture).

The biggest kicker to beign able to receive this loan is that the property has to be located in certain Geographical Areas (Metro Duluth has several counties that qualify).

Highlights of ths program are:

-

ZERO (0) down payment

-

Lower Monthly Mortgage Insurance Premium than FHA

-

Seller contributions and gift funds are allowed

-

30 yr fixed Rate Mortgages - at Very good rates- similar to FHA

-

NO Prepayment Penalty

-

Repairs can be financed into the loan in most cases